Shaping the Future of Digital Assets

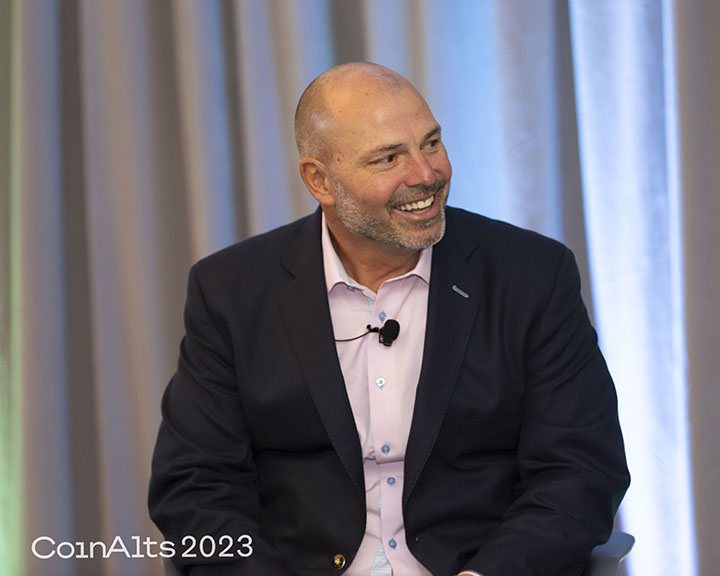

On October 16, 2024, CoinAlts hosted the latest in a series of events for the digital asset community addressing investment, legal, and operational issues pertaining to private fund managers.

Established in 2017, CoinAlts is an annual gathering and forum for the digital asset community. 2024 Premier Sponsors Cole-Frieman & Mallon LLP, MG Stover LLC, Harneys, and KPMG have practices devoted to fund managers in the digital asset space.

2024 Agenda at a glance:

Meet our speakers:

Mike Belshe is the Co-Founder and CEO of BitGo and Internet Pioneer. At BitGo, Mike drives product and business strategy for delivering security, compliance, and custodial solutions for blockchain-based currencies. Prior to BitGo, he was one of the first engineers dedicated to building Chrome at Google. Mike is creator of the SPDY protocol and lead author of HTTP/2.0—the internet protocol responsible for loading web pages today. In 2003, Mike co-founded Lookout Software—an email search company acquired by Microsoft. He has held management positions at several startups, including Netscape, Good Technology, and Critical Path. Mike is also an inventor with over 10 technology patents.

Edward Baer is counsel in Ropes & Gray’s asset management group. His practice focuses on advising ETFs and other investment companies, their sponsors, and their boards. He has deep experience in operational, governance, compliance, regulatory, capital markets, and business issues related to ETFs and other investment companies and asset managers. Ed advises clients on efforts to list a “spot” bitcoin and ether ETFs, as well as on other types of investments in cryptocurrencies, SAFTs, cryptocurrency fund formation and related trading, custody and valuation issues. Ed was previously managing director and senior counsel for the world’s largest asset manager and also served as Chief Legal Officer for the world’s largest ETF complex.

Matt is responsible for the institutional financing business at Coinbase, a multi-product business delivering solutions to Coinbase’s strategic institutional customers. Matt joined Coinbase from Numerai, a quantitative hedge fund, where he was President and Chief Operating Officer responsible for portfolio management, trading, operations, and marketing. Previously, he led Capital Markets at Sensato Investors, a quantitative hedge fund, where he managed the systematic optimization of the firm’s financing, trading model, and foreign exchange investment model. Matt spent much of his career at BlackRock, where he was responsible for Equity, Fixed Income, and Prime Finance trading.

Lee Bratcher is the President and Founder of the Texas Blockchain Council. The Texas Blockchain Council (TBC) is an industry association with more than 100 member companies and hundreds of individuals that seek to make Texas the jurisdiction of choice for Bitcoin and blockchain innovation. The TBC has passed four pieces of pro-crypto legislation over the past several years. Lee and the TBC team have a specific focus on the regulatory environment around Bitcoin mining in Texas. The TBC hosts the North American Blockchain Summit at which speakers like Senator Ted Cruz, Vivek Ramaswamy, Senator Cynthia Lummis, and SEC Commissioner Hester Peirce address sold-out audiences.

Joe Brennan is a Senior Vice President in the firm’s Valuation and Financial Advisory Group. His primary focus is servicing cryptoasset clients, working closely with fund managers to solve their unique portfolio valuation challenges. Previously, Joe worked at Cohen & Company, where he specialized in illiquid cryptoasset valuations for well-known fund clients as they navigated this emerging asset class. He also has previous experience issuing fairness opinions and preparing annual valuation updates for ESOP-owned companies. Joe has a BS in Accounting and Finance from Marquette University and is a Certified Public Accountant.

Jonathan is a Partner in McDermott Will & Emery’s Financial Institutions practice. Drawing on his experience as in-house counsel, Jonathan advises emerging companies, financial institutions and investment managers on the use of blockchain, crypto assets and tokenization across the capital markets including token launches, market infrastructure, trading, clearing and settlement solutions and the lending, pledging and holding digital assets. Before joining McDermott, Jonathan was a Partner at an international law firm, Counsel at D. E. Shaw & Co., L.P. and a Vice-President in Structured Credit at J.P. Morgan Chase and Bear Stearns.

Pat joined MG Stover in 2022 to lead digital asset strategy and growth initiatives. His experience blends traditional financial fund operations with years of supporting leading crypto projects. At MG Stover, Pat focuses on expanding client offerings and developing future solutions with the product team. Previously, he led strategy at Armanino’s Blockchain & Digital Asset practice, driving exponential growth in their consulting services. His team pioneered the integration of blockchain technology with accounting standards to provide real-time reporting on digital assets using various attestation standards.

Karl Cole-Frieman is Managing Partner of CFM and serves as counsel to many of the most prominent hedge fund managers in the U.S. Known in the industry for the range of his expertise regarding this client demographic and his innovative work with managers who invest in non-traditional asset classes, Karl is highly sought after for business-oriented and practical advice stemming from his long career working as both an in-house and external adviser. He has guided hundreds of start-up managers by launching their first fund and has the breadth of experience to advise very large managers. He is a trusted adviser and is nationally recognized as a leading cryptocurrency lawyer, representing many of the largest cryptocurrency fund managers in the U.S

Camille is a Relationship Manager at Anchorage Digital, where she works with clients on a variety of strategies and business integrations. Prior to joining Anchorage Digital in 2021, Camille spent three years as SVP of prime brokerage sales at BTIG, and eight years at BNP Paribas selling global equities, capital markets, and structured prime financing. She brings extensive experience from the traditional prime brokerage sales world. Camille has a BA in Business Administration from Hofstra University.

Ben Crook is the Regional Vice President, Market Leader for the West Coast Region at Grayscale. Prior to Grayscale, Ben has spent the past 10 years in ETF Distribution at firms such as State Street Global Advisors, Pacer Financial, and Tema ETFs covering RIAs, Family offices, and Institutional clients.

Reid Cuming is the COO & Co-founder of Superstate. Prior to Superstate, Reid served as VP and General Manager of Compound Treasury, the first DeFi company to get a credit rating from S&P, which offered institutions compliant fixed yield on their cash via the Compound protocol. He has also held roles at fintech companies Block (f.k.a. Square), Stripe, and Chime. Beyond his professional endeavors, Reid is an angel investor and advisor to a variety of tech companies, leveraging his expertise to support innovation and growth in the industry. He is also a board member of Reid Youth Charities in Texas.

Kyle DaCruz joined VanEck in 2017, and serves as Director, Digital Assets Product. He is responsible for product development and expanding VanEck’s digital asset product offerings, as well as the management and market strategy of VanEck’s existing digital asset product lineup. Prior to joining VanEck, Kyle served as a Product Information Analyst with Putnam Investments. He received a bachelor’s degree from the University of New Hampshire.

John Divine is a financial markets professional focused on structured products, derivatives, lend, borrow, and spot market execution for digital assets. He began his career as a market maker for the Chicago Mercantile Exchange and the Intercontinental Exchange-listed derivatives, specializing in precious metals, interest rates, energies, and forward volatility curves. John has also operated within environmental product markets, listed, and OTC for compliance and voluntary participants. He moved into the digital asset arena trading as an Execution Specialist for an industry-leading hedge fund before joining BlockFills, where he is currently engaging with institutional participants in digital asset markets on strategy development & execution.

Katherine Dowling is on the Executive Management team and is the General Counsel and Chief Compliance Officer of Bitwise Asset Management. She previously served in General Counsel, CCO, and COO roles at several financial and private equity firms, and was a co-founder, Managing Director, and COO of Luminate Capital Partners, a software private equity firm in San Francisco. A Harvard Law School graduate, Katherine spent over a decade as a federal prosecutor, most recently in the Economic Crimes Unit of the U.S. Attorney’s Office for the Northern District of California, where she worked with the FBI, SEC, IRS, and other agencies to prosecute insider trading, fraud, and money laundering cases, among others.

Prior to joining as CIO of Anagram Ventures, David was Founder and Managing Partner of Galileo, an early stage crypto venture fund. Previously, he spent 10 years in Corporate and Investment Banking, focused on sourcing, structuring, and portfolio management of +$300mm venture and senior debt facilities. Prior to that, David was focused on M&A and capital formation advisory for early-stage tech.

Gautam Ganeshan is a Partner in KPMG Cayman Islands’ Asset Management practice. Gautam co-founded and is one of the leaders of the Digital Asset Audit Practice at KPMG Cayman Islands. His portfolio of clients includes digital asset funds, venture capital funds, hedge funds, and credit funds. Gautam has over 17 years of assurance experience and has worked with a full range of clients from across the world. He is a Director on the Board of Directors of the CFA Society Cayman Islands.

Philip Graham is global head of Harneys Investment Funds and Digital Assets groups. He advises on the laws of the BVI and the Cayman Islands and is an internationally recognized leading advisor on all aspects of offshore investment funds, including pre-formation strategy, regulatory compliance, and restructuring. Phil has over 20 years of experience advising in connection with all types of fund vehicles, and start-ups operating in the fintech space having launched one of the very first digital asset-focused funds in 2015. Phil serves as chairman of the BVI Investment Funds Association and has consulted frequently with the BVI government and the regulator on legislative development and the impact of regulatory change for over fifteen years.

Elise Gray is the Head of Accounting and CFO Support Services, Americas at IQ-EQ. In her six-year tenure, she has served as an Outsourced CFO for 25+ Asset Managers ranging in AUM from 30M to 11B across Hedge Funds, Fund of Funds, Private Equity, and Venture Capital. She also leads the Regulatory Reporting Group that is responsible for the preparation and submission of Form PF and Annex IV filings for 500+ fund structures. Prior to joining IQ-EQ, Elise worked in the private equity group at Fortress Investment Group, a $45 billion-dollar investment manager, overseeing the operations and day-to-day accounting of 20+ credit fund structures.

Paul Hsu is CEO and Founder of Decasonic, the venture and digital assets fund building blockchain innovation. Paul was previously a leading social gaming developer, who led Zynga’s IPO. Beginning in 2013, he expanded this expertise into investing in blockchain technology. Paul’s early career included early-stage venture investing at NeoCarta Ventures, a $300M fund based in Silicon Valley, as a founding team member and key investment professional in the fund. He holds a Bachelor of Arts from Yale University, where his studies concentrated on economics, math, statistics, and international politics. Paul graduated Phi Beta Kappa and magna cum laude.

Sam is a global macro investor with over 15 years of experience trading a wide range of asset classes. Most recently, he built and ran Crypto at Moore Capital in New York City. Prior to Moore Capital, Sam launched the first global macro fund that could trade digital assets out of Mike Novogratz’s Family Office. While there, he helped pioneer the crypto options market and executed the first ever option on ETH. He began his career at Bear Stearns and then JPMorgan where he worked in proprietary trading until the Volker rule was enacted in 2012. Sam is a regular participant at the US Monetary Policy Forum and an adviser to Scroll and the Liquid Collective.

Omar is a Partner at Dragonfly. Previously, he was an investor at AKFED and Brookfield, and an investment banker at National Bank of Canada. Omar holds a BSc from Cornell, and an MBA from Harvard Business School. He is a CFA Charter holder.

Ms. Levin currently serves as Executive Vice President of Regulatory and Compliance at Figment. Prior to joining Figment, Ms. Levin worked at DraftKings where she was responsible for navigating the complex regulatory issues related to Web3, Sportsbetting, and Casino. From approximately 2010 – 2019, Ms. Levin served as an Assistant United States Attorney in the Northern District of Illinois, where she focused on financial crimes, and has been an adjunct professor in Trial Advocacy at Northwestern Law School for the last 11 years. Ms. Levin earned her B.A. in Psychology from the University of Wisconsin-Madison and her J.D from Northwestern University School of Law.

Andrew Levine is a partner with BraunHagey & Borden. As a trial lawyer and business advisor, he helps clients navigate a wide array of disputes and challenges. He has successfully litigated in federal and state courts and arbitrations across the U.S., including matters involving cryptocurrency funds, investments, valuations; financial services, corporate governance, IP, antitrust, employee/professional mobility, trade secrets, breach of contract, fiduciary duties, and class actions. Andrew represents Fortune 500 companies, investment managers, financial services firms, small businesses, start-ups, and individuals. He graduated from Wesleyan and U.C. Berkeley School of Law (Order of the Coif) clerking for Honorable Edward Korman (E.D.N.Y.).

Bart Mallon is Managing Partner of Cole-Frieman & Mallon LLP and serves as counsel to many of the most prominent hedge fund managers in the United States. Bart provides comprehensive and tactful advice to clients regarding structure, operational items and compliance matters. He has held many exam licenses, including Series 3, Series 7, Series 24, Series 34, Series 63, and Series 65. Additionally, Bart created the nationally recognized Hedge Fund Law Blog which is often quoted in high-profile publications such as the Wall Street Journal, Bloomberg Compliance Update, and Absolute Return + Alpha. Bart lives in San Francisco and is an avid golfer.

Drew Myers is a co-founder and Managing Partner of CrossLayer Capital. He was previously a Managing Director at Makena Capital where he spent 12 years on Makena’s Private Equity team focused on Venture Capital. Drew developed the firm’s thesis for crypto and blockchain, and led the firm’s investments in the space over three years. He has a BA from Eugene Lang College and an MBA from Tuck School of Business at Dartmouth.

Mahesh is a co-founder of EV3. He is originally from Chennai and was raised in New York. Mahesh studied Economics & Religion at Harvard University. After he graduated, Mahesh started his career at Goldman Sachs. Before EV3, Mahesh was an investor in Apollo Global Management’s private equity business, focusing on LBOs and new business creations in telecom and financial services.

As a Partner at Cole-Frieman & Mallon LLP, David advises clients on the formation and structure of domestic and offshore investment funds, separately managed accounts, management company matters, as well as marketing and investor relations. He represents a wide variety of funds, ranging in size from startups to multibillion-dollar firms. Prior to joining Cole-Frieman & Mallon LLP, David was an associate at Baker & McKenzie LLP in San Francisco. He represented clients in various matters, including mergers and acquisitions, securities transactions, and corporate formation and structuring. David received his undergraduate degree from the University of Southern California and his law degree from Georgetown University Law Center.

Justin Schleifer is the CEO and Co-Founder of Aspect Advisors. He has spent his entire career in compliance, acting as a consultant, in-house CCO, and outsourced CCO for a variety of firms. He first started in digital asset compliance in 2017, which was a driving force in founding Aspect. Justin’s CCO highlights include: wealth managers/RIAs, fund-of-funds, internet-based investment advisers/financial planners, private placement/M&A investment banks, and a cryptocurrency robo-advisor. He has also served as the Financial Operations Principal for several broker-dealers. Justin earned his Bachelor of Science degree from Cornell University. He holds 13 FINRA series licenses and has served on FINRA’s Continuing Education Committee.

Ruby Sekhon is Partner, Chief Legal Officer and Chief Compliance Officer at Polychain Capital LP, a premier investment firm focused on cryptocurrency and blockchain technology. Polychain Capital LP was the first digital assets advisor to register with the SEC and she was the first CCO in this space under SEC registration. Ruby is in her seventh year at Polychain but prior to joining, Ruby has held positions as General Counsel and Chief Compliance Officer at Valiant Capital Management, Patriarch Partners, and GoldenTree Asset Management, L.P. She holds a B.A., Hons from McGill University, a Masters in Public Policy from Harvard Kennedy School, and a combined J.D. from Harvard Law School and Canada’s Osgoode Hall Law School.

Jigar Shah is Vice President of Finance at Hack VC Management, a prominent crypto venture capital fund, overseeing financial data tracking, controls, valuations, and reporting for both funds and the Management Company. Previously, he held senior financial leadership roles at Digital Currency Group (DCG), a major holding company in the crypto sector with extensive investments and subsidiaries. At DCG, Jigar played a key role in establishing and expanding the finance function. Prior to DCG, he gained significant fund management and reporting experience at Brookfield Property Group and Conifer Financial Services, where he contributed to managing large real estate and private equity funds, respectively.

Nihar Shah is the Head of Data Science at Mysten Labs, where he currently works on topics around network effects, Sybil detection, and on-chain experimentation. He has also worked at Jump Crypto and on Meta’s Libra/Diem project, as an economist. Nihar earned a Ph.D. in Economics, an AM in Statistics, and an AB in Economics, all from Harvard University.

Rich is the founder of Silvermine Capital (http://www.silverminecapital.com), a firm that has managed technology investments dating back to the earliest days of the Internet. Since 2019, Silvermine has focused on digital assets, typically investing at the pre-seed and seed-stage, while also maintaining a liquid portfolio. Rich and his team often take an active operating role in support of their core investment ideas via their affiliated development company, Lucky Friday Labs (http://www.luckyfriday.io/), and blockchain infrastructure operation, GlobalStake (http://www.globalstake.io/). Rich began his career as a corporate attorney at Cravath, Swaine and Moore, LLP and has served as a director on numerous public and private boards.

Matt began his career as a CPA at PricewaterhouseCoopers and Spicer Jeffries. In 2007, after growing frustrated with the data he was receiving from fund administrators, Matt decided to start his own firm. His entrepreneurial spirit and goal to create a unique, invaluable service offering has shaped the standards and culture that we adhere to today. As CEO, Matt leads the strategic and visionary activities for the firm. He ensures that accountability, efficiency, and forward thinking are at the forefront of what they do at MG Stover. Matt has been integral in the evolution of the crypto hedge fund industry. In 2017, he co-founded CoinVantage, a portfolio accounting and reporting system for digital assets.

Robert Strebel joined diversified trading firm DRW in 2021, and is the Global Head of Relationship Management. His responsibilities include managing the firm’s institutional relationships across its TradFi and crypto businesses. He is focused on ensuring DRW has a best-in-class, unified offering for counterparties. Prior to DRW, Rob worked at UBS for over 20 years, specializing in marketing global derivative products to hedge funds, banks, insurers, and traditional money managers. Rob holds an economics degree from Queen’s University in Canada.

With two decades of experience as a Cayman Islands lawyer, Matt Taber is a leading expert at Harneys, based in their Cayman office. Known for his deep understanding of transactional law, Matt specializes in areas crucial to the Cayman Islands’ financial services sector, particularly crypto funds, Web3 projects, and virtual assets. He advises clients on investment funds and management, mergers and acquisitions, and Series A financing. His expertise extends to the evolving regulatory landscape surrounding virtual assets and blockchain. Matt is also actively involved in the industry, serving on the board of the Cayman Islands chapter of AIMA and previously acting as the secretary of the Blockchain Association of the Cayman Islands.

Neil Thakur, a Managing Director and founding member of Teknos Associates, brings 25 years of experience in valuation, investment banking, venture, and corporate finance to his role. He holds a BA in Economics from Yale University and is a Certified Valuation Analyst. At Teknos Associates, he provides valuation and strategic advisory services to clients in areas such as M&A, management consulting, investments, tax, and financial reporting. Over the past 15 years, Neil has worked with companies across various emerging growth technology sectors, with a particular focus on the blockchain and cryptocurrency industries.

Lekker Capital is a global macro hedge fund with a particular focus on the emerging digital asset industry. Prior to founding Lekker, Quinn served as the Head of Capital Markets for two institutional lending businesses in the digital asset ecosystem, most recently at Maple Finance. Quinn spent five years in fixed income and capital markets at Guggenheim Partners in New York before his full-time foray into crypto.

Ben’s 20 years of trading and structured finance experience led him to senior leadership roles at Merrill Lynch and AllianceBernstein where he led business strategy and managed profitable distribution teams in Tokyo, Hong Kong, Singapore, Seoul, and Taipei. Ben looks after product development and trading for Wave Digital Assets, also holding numerous security licenses.

Tony is a Principal in KPMG LLP’s Alternative Investment Tax practice and leader of the firm’s digital asset tax practice. He has more than 25 years of experience in tax and is responsible for tax structuring and tax advisory services for a broad range of asset management clients including hedge funds, crypto funds, fund of funds, private equity, and venture capital funds. Tony also has expertise in the taxation of financial products, digital assets, and complex capital markets transactions.

A seasoned venture investor with over a decade of experience in identifying and nurturing startups across various tech sectors. With 26 years in capital markets and private equity, he specializes in Web3 and crypto, leveraging deep knowledge of emerging technologies and trends. His career began at Moody’s Investors Service, where he advanced to Director of Risk Management before transitioning to venture capital at Q-Bank Group. There, he worked with institutions like Oxford, MIT, the DoD, and IARPA, focusing on machine learning, cybersecurity, and digital health. Investing in crypto since 2012, he now spearheads early-stage ventures and strategically employs DeFi protocols to maximize investor returns.

Tony is the Global Head of Government Relations and Legislative Affairs for OKX. Prior to this role, he served as the General Counsel of Okcoin/OKX. After spending six years in private practice after law school, Tony was an in-house attorney in Morgan Stanley’s client litigation group in San Francisco. In 2012, he joined Charles Schwab as a Managing Director, serving ten years in Schwab’s litigation and regulatory enforcement group. While at Schwab, Tony served as the lead, in-house attorney managing the DOJ’s antitrust investigation into Schwab’s successful acquisition of TD Ameritrade in 2020. He holds a Political Science degree from UC Berkeley and a law degree from USC Law School.

Marcos is a Partner at Accolade Partners, a venture capital and growth equity fund of funds in Washington, DC, with over $6.0 billion in total assets under management and over $1.3 billion in blockchain venture capital assets. Prior to Accolade, he was a Partner at Evanston Capital Management. Before joining Evanston, Marcos worked at Cambridge Associates where he worked mainly with endowments and foundations, in the US and Europe, on their investment strategy. He also led the firm’s emerging research in the crypto/blockchain space starting in January of 2018. Marcos holds a BA from Oxford University and an MA and MBA from Columbia University.

As ARK’s General Counsel, Forest is responsible for overseeing and advising on all legal and compliance matters. Previously, he was GC of Angelo, Gordon & Co., L.P., where he led the global legal and compliance functions. Forest was an Executive Director at Morgan Stanley, where he oversaw US legal coverage of the Private Wealth Management Division. Also, he provided legal coverage for a variety of Morgan Stanley businesses. Forest began his legal career at Sullivan & Cromwell LLP, specializing in securities, mergers & acquisitions, and general corporate law. He holds a B.A. in International Studies from Emory University and a J.D. with High Honors from Emory University School of Law. He is admitted to practice law in New York and Florida.

Kevin Wysocki is the Director of Policy at Anchorage Digital. He works with stakeholders throughout the digital asset ecosystem to enhance government policies regulating the industry. Before joining Anchorage Digital in 2022, Kevin worked on Capitol Hill for more than seven years where he helped enact five financial services bills into law. He served as professional staff for the House Financial Services Committees and Congressman Andy Barr (KY). Before that, he was Senior Legislative Assistant for Congressman Tom Emmer (MN). Kevin previously did government affairs work for both Meta and Hogan Lovells. He holds an MBA from the Quantic School of Business and Technology and has a BS and a BA from the State University of New York at Fredonia.

Other SF Fund Week Events:

Sohn San Francisco Investment Conference

CalALTs SF Fund Week Networking Reception

CoinAlts 2024 Fund Symposium

HFC PE|VC Cares Art Battle

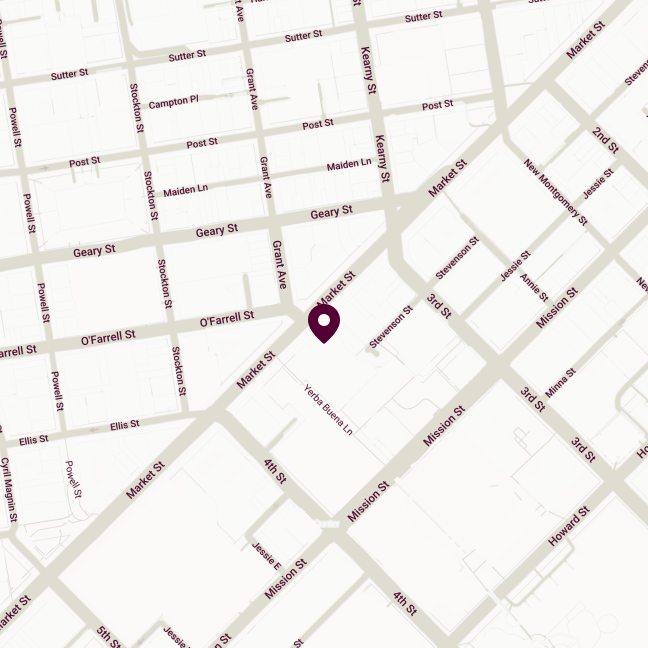

CoinAlts 2024 will be hosted in San Francisco.

Four Seasons Hotel SF

757 Market Street

San Francisco, CA 94103

Get in touch

We look forward to seeing you at the next CoinAlts Fund Symposium! If you have any questions, please feel free to reach out.

Sponsor Us

Apply to sponsor and make a lasting impact at the CoinAlts Fund Symposium, the premier gathering for the digital asset community. Showcase your brand to industry leaders, forge valuable connections, and position your company as a thought leader in the rapidly evolving crypto investment landscape. Don’t miss this opportunity to elevate your brand presence and drive the future of digital asset investments.